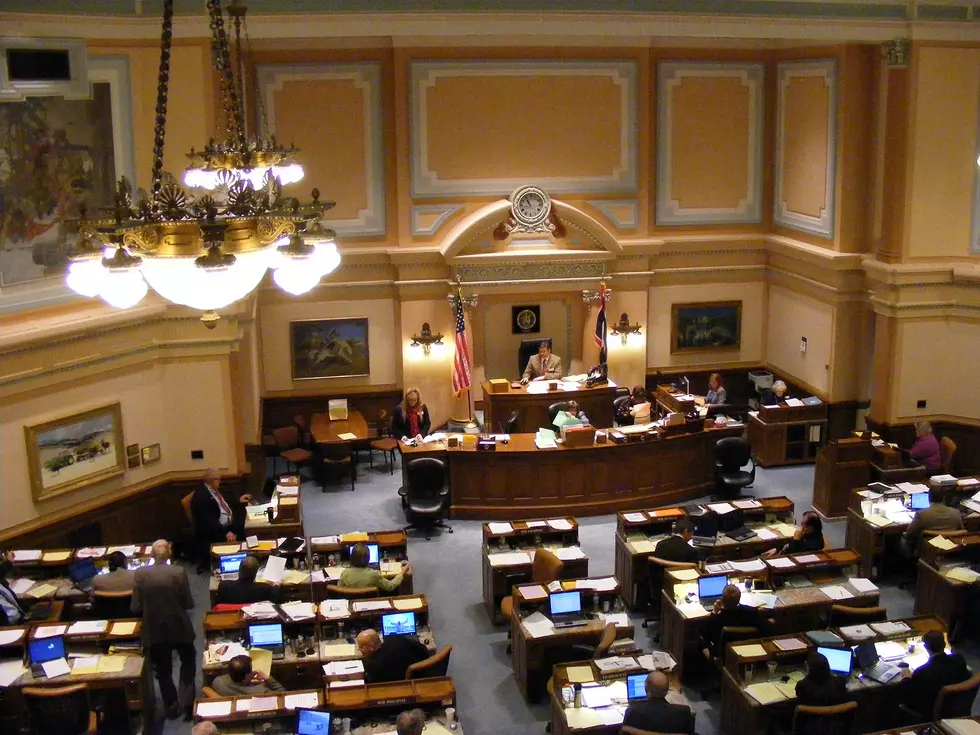

Cigarette Tax Increase Proposed In Wyoming Legislature

A bill that would increase the state taxes on cigarettes sold in Wyoming has been filed for the 2023 legislative session.

House Bill 58 would increase the state wholesale tax in cigarettes from the current three cents per cigarette for five and two-tenths cents. That would raise the state tax on a pack of cigarettes from the current 60 cents to $1.04.

A fiscal note attached to the legislation projects the measure would raise over $9 million per year, with most of the money going to the state General Fund:

FISCAL NOTE

| FY 2024 | FY 2025 | FY 2026 | |

| NON-ADMINISTRATIVE IMPACT | |||

| Anticipated Revenue increase | |||

| GENERAL FUND | $7,740,000 | $7,740,000 | $7,740,000 |

| LOCAL SOURCES FUND | $1,370,000 | $1,370,000 | $1,370,000 |

Source of revenue increase:

This bill increases the cigarette tax from $0.60 per pack to $1.04 per pack.

It is assumed that this cigarette tax increase would result in a 12% decline in

cigarette consumption.

Assumptions:

The above estimate is based on the cigarette taxes forecasted to the General Fund in the October 2022 Consensus Revenue Estimating Group (CREG) Forecast. The revenue increase from the cigarette tax rate increase is estimated at $7.74 million per year to the General Fund and $1.37 million per year distributed to local governments.

Due to the magnitude of the tax increase, a 12% reduction in sales is projected

from reduced consumption. There is also a potential impact to this revenue increase from the likely reduction in Wyoming cigarettes sold for consumption outside of Wyoming. However, this potential impact is unknown, and therefore not incorporated into the above estimates.

The Department of Revenue (DOR) assumes no administrative impact from this bill under the following assumptions:

- The cigarette stampers and the DOR will be able to use up any current stamp inventory. If not, there will be additional costs of $6,840 per each 6,000,000 stamps purchased (the DOR usually purchases at least 6,000,000 cigarette stamps each quarter). Once the current inventory is sold before the July 1, 2023 effective date, the DOR could then coordinate with their supplier and order new stamps (likely in a different color).

- The system programming by our third-party IT contractor will be minimal. Potential unknowns could increase the programming cost. This update would also require updated forms and testing by both DOR and contractor staff.

The expenditure increase described above could be considered an administrative cost but is included above for the purpose of full disclosure.

2022's Deadliest Wyoming County by Traffic Deaths

- 3 Dead After Semis Collide on I-80 East of Cheyenne

- Wyoming Highway Patrol Releases More Details in Fiery I-80 Crash That Killed 3

More From Wake Up Wyoming